EQUIPMENT BUSINESS LOANS

Finance machinery, tools, or essential equipment.

Equipment Business Loans

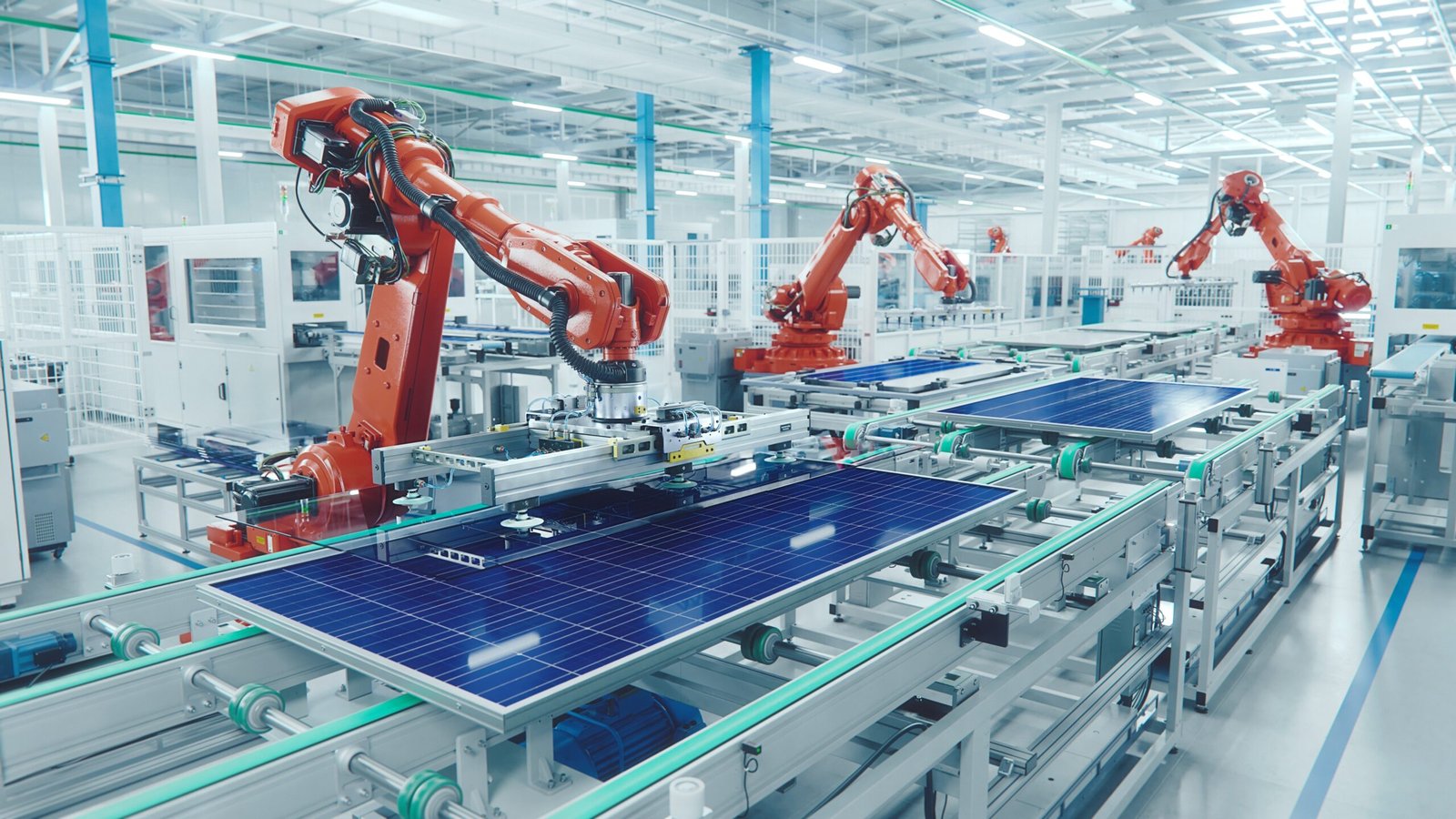

An equipment loan is a type of financing specifically used to purchase machinery, tools, or other essential equipment needed for a business’s operations. Instead of paying upfront for new equipment, a business can borrow funds to acquire it, then repay the loan over time.

How a Business Can Use an Equipment Loan:

- Purchasing Machinery: For manufacturing, construction, or industrial operations.

- Upgrading Technology: Buying computers, servers, or software systems.

- Acquiring Vehicles: Company cars, delivery trucks, or forklifts.

- Renewing Equipment: Replacing outdated or broken equipment to maintain productivity.

- Expanding Operations: Investing in additional equipment to scale production or service capacity.

Preserves Cash Flow

Enhances Business Growth

Summary, equipment loans are a practical solution for businesses looking to invest in necessary tools or machinery while maintaining healthy cash flow and reaping tax advantages.

Benefits of an Equipment Loan:

- Preserves Cash Flow: Businesses don’t need to pay the full cost upfront, freeing cash for other needs.

- Tax Deductions: Payments toward interest and possibly depreciation on the equipment can be tax-deductible.

- Fast Access to Equipment: Quickly acquire essential tools or machinery to meet operational demands.

- Improves Cash Flow Management: Spreads the cost of expensive equipment over the useful life, easing budget planning.

- Enhances Business Growth: Enables faster expansion or modernization without large upfront capital expenditure.

- Fixed Payments: Predictable repayment schedule helps with budgeting.

Regarding tax benefits, borrowers loans may enjoy:

- Annual Tax Deductions: Mortgage interest payments on the loan are typically tax-deductible, reducing taxable income.

- Depreciation Benefits: The property can be depreciated over time, leading to annual deductions that improve cash flow and reduce tax liability.

- Many of your closing costs and interest paid on the loan could be used to lowering taxable income